Back

Finacle’s Wealth Management Platform

Designer’s Note:This project showcase highlights the strategy on deliverable end product. For detailed case study, I’d love to connect!

Client

Finacle

Location

India

Industry

Retail Fintech

Team

8 Members

About

This wasn’t just an MVP, It was a Minimum Viable Promise

A promise that wealth can be human.

- We partnered with Infosys EdgeVerve to design Finacle’s, a next-gen wealth management platform for High-Net-Worth and Ultra-High-Net-Worth individuals.

- Over 10 months, 5 design sprints, and 5000+ screens, we created a global solution built for local impact. A modular MVP that empowers banks to reimagine wealth experiences across diverse markets.

My Role

As a Story Owner

Secondary Research

User Journey

Creating User Stories

High Fidelity Design

Prototype

As a Design Lead

Led sprint planning, backlog prioritisation, & design reviews.

Guided a distributed UX team across zones, building alignment through - Design Scrum & “war room” collaboration sessions.

The Challenge

A Fragmented & Inflexible Financial Experience

The Problem

- The traditional wealth management landscape is rigid and one-size-fits-all. High-Net-Worth (HNW) and Ultra-High-Net-Worth (UHNW) clients are increasingly tech-savvy, but their digital experiences are lagging.

- They're looking for more than just a balance sheet; they want a personalised, holistic view of their financial life.

The Opportunity

- Build a white-label platform that empowers banks to deliver a truly personalised, modular, and engaging wealth management experience.

- This wasn’t about digitising existing services; it's about reimagining the client-advisor relationship.

A Realisation

The Localisation Gap

The meaning of "wealth" varies across cultures, affecting

everything from investment priorities to family dynamics.

• This is why our strategy was to use a flexible template that can be

localised to Bank’s preferences.

• It demonstrates that we're focused on long-term growth and

understanding specific market differences, not just on creating

a single product.

Product Strategy

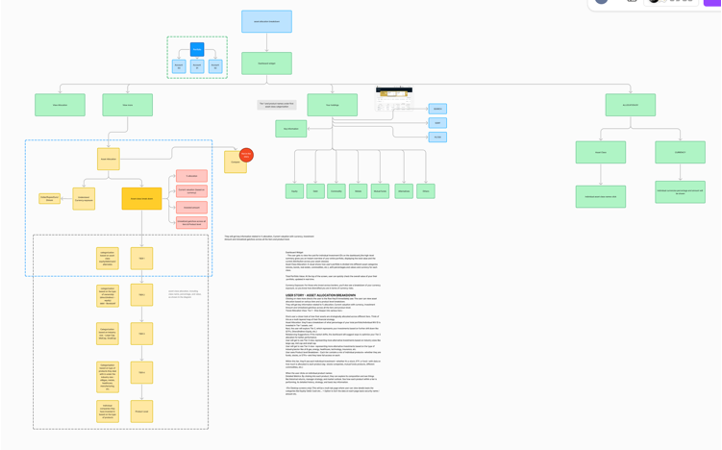

Our goal was not just to ship screens—but to ship speed, scalability, and a foundation banks could trust. To do this, we built an Accelerated UX Development Framework, anchored on three strategic pillars

- Stakeholder-Driven Discovery

- Conducted intensive workshops with Product Owners, to gain insights on Relationship Managers, and Financial Advisors which then we synthesised into user journey maps that highlighted pain points.

- By co-creating with stakeholders early, we collapsed the traditional discovery timeline and gained direct buy-in, making design sprints more efficient and aligned.

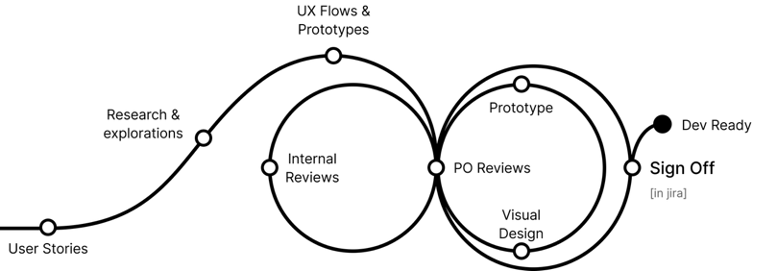

- Scrum + Waterfall Hybrid for UX (Figma + Jira)

- Used Scrum for sprints: story-level ownership, rapid iterations, real-time blockers resolved in “war room” sessions.

- Used Waterfall for releases: aligned with development milestones, ensuring stakeholders saw full, functional flows instead of disjointed wireframes.

- This hybrid model gave us the best of both worlds: agility in design + predictability in delivery.

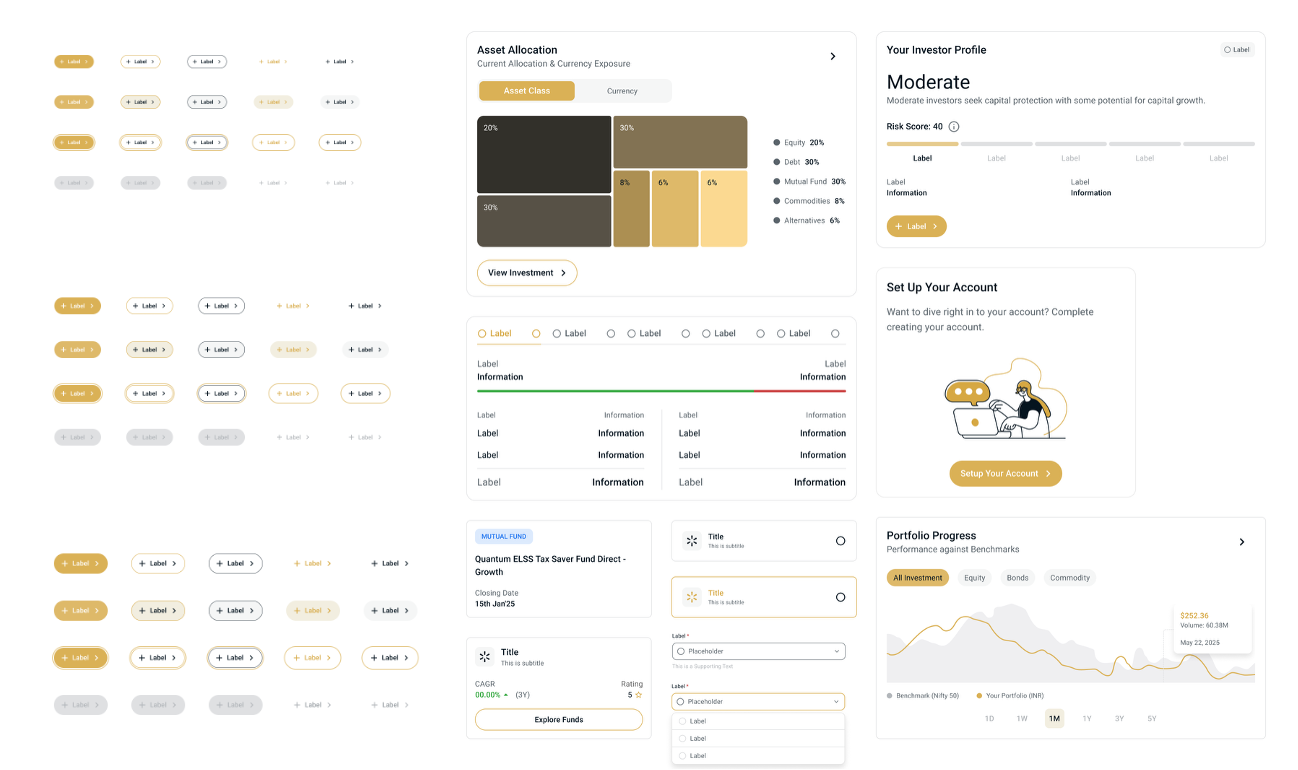

- Global Templatised Component Library

- Created an atomic-level design system (widgets, charts, visualisations) as a global kernel.

- Every component was: Reusable across features, Customisable for brand identity, Localisable to reflect cultural/regulatory differences

- This future-proofed the platform, ensuring each bank could launch fast, localise faster, and scale sustainably.

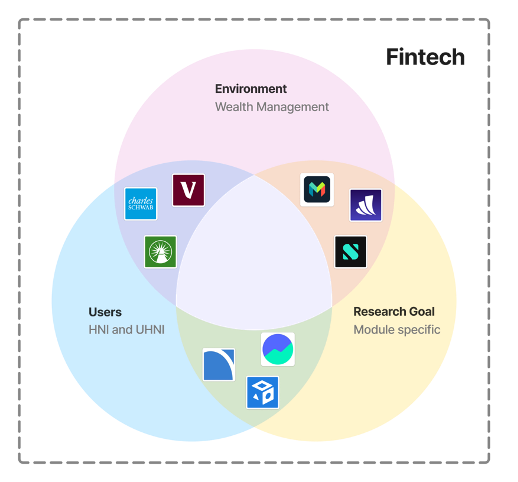

Secondary Research

No direct global competitor existed in digital wealth management at large scale. So we pivoted—acting as digital detectives:

- Competitive Landscaping

- Researched adjacent solutions like Groww (multi-asset investment) and WealthFront (risk profiling) and identified gaps.

- These insights shaped opportunities for differentiation: e.g., multi-entity dashboards, holistic financial life views, and advisor-integrated communication.

- Pattern Mining & Interaction Analysis

- Leveraged 11FS Portal to dissect flows across investment, banking, and fintech products.

- Analysed: onboarding patterns, error handling, navigation models, micro-interactions.

- This helped us uncover mental models users already had e.g., swipe for account switching, WhatsApp for advisor chats.

Even without a live user cohort, research gave us the confidence to design with accuracy. We didn’t guess, we triangulated patterns, borrowed from proven domains, and leapfrogged competitors with differentiated value.

Deliverables

Platform

Mobile -

(w)390 x (h)844

Desktop -

(w)1920 x (h)1080

DescriptionWe adopted a mobile-first approach, designing for smaller screens first to prioritise clarity, speed, and usability. Once optimised for mobile, we scaled the experience to desktop—ensuring a fully responsive design that adapts seamlessly across devices.

Key Features

We created ‘Not just feature’ — but the full journey.

18+ stories, 38+ flows & 2 Versions of Design System

Every screen with modular system.

Every functional flow templatised.

For Banks:

- Modular Design: Pick-and-choose features, rapid customisation

- Scalable Architecture: Local market adaptations in weeks, not months

- APIs & Theming: Seamless ecosystem integration + brand identity flexibility

For End-Users:

- Seamless onboarding without duplicate inputs

- Holistic dashboard with assets, currencies, and multiple accounts

- Human connection through RM Connect + WhatsApp Banking

- One-stop investment platform for equities, bonds, mutual funds, and insurance

Tangible Indicators Of Success

- The sales team used the prototype to demonstrate the app to banks, leading to two enterprise buy-ins. Banks were thoroughly impressed by the modular system features, which showcased flexibility, scalability, and ease of customisation.

- Internally, at Finacle, this project set a new benchmark: we created functional flow templates that other tracks can now reference, establishing a reusable design framework across products.

This project proved that design can go beyond aesthetics - it can influence business outcomes, accelerate sales, and create scalable systems that shape future product tracks.